Reaching out to property seekers and investors across Southeast Asia

The pandemic has unsurprisingly tempered demand for real estate property in Southeast Asia.

In Singapore, the combination of lockdown measures and stay-at-home orders, referred to by the government as Circuit Breaker, resulted in only 486 new private homes (excluding executive condominiums) being sold in June 2020 —a 48.9% decline from the 952 units transacted in May 2019.

However, the long-term outlook for the region remains optimistic. This number is already a 75% increase compared to the 277 units sold in April 2020, to the surprise of many analysts.

While the International Monetary Fund (IMF) predicts that the economies of Southeast Asia’s ASEAN-5 (Singapore, Malaysia, the Philippines, Indonesia, and Thailand) will be in the doldrums until the end of the year due to the spread of the coronavirus, a sharp economic recovery of 7.8% is expected in 2021. This, in turn, is expected to bolster long-term interest in the region’s real estate markets, particularly among international investors.

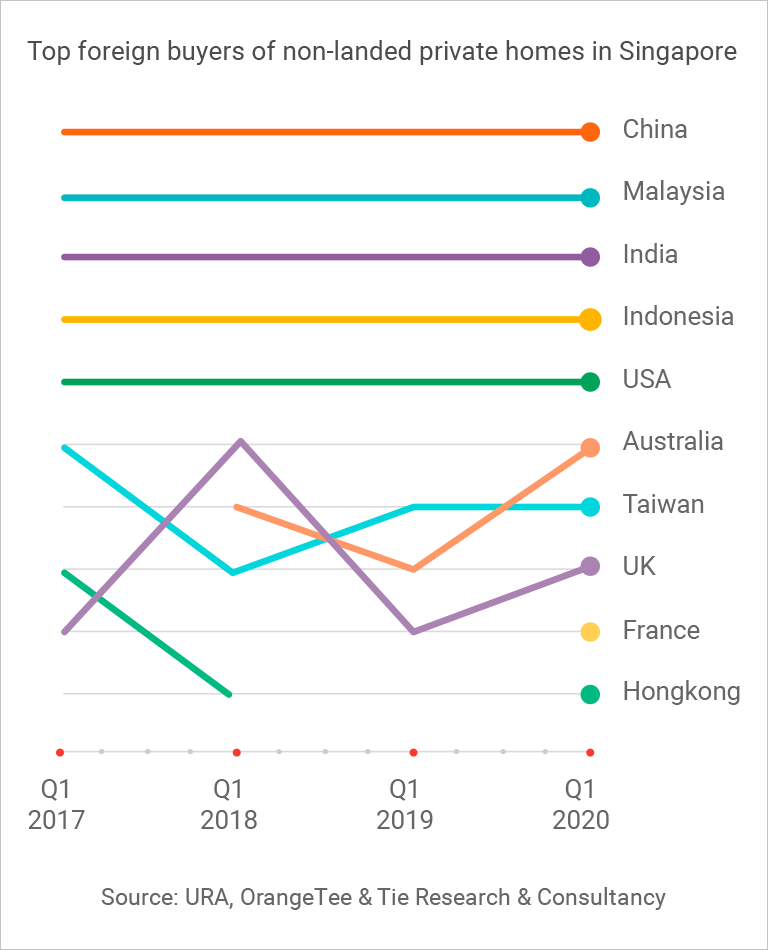

In fact, searches for Thai real estate by Chinese buyers rose by 24% in February and March. A survey of real estate agents shows that now is a good time for foreign nationals to snatch up property in the Philippines, Malaysia, Thailand, and Singapore as the lull in local demand is likely to encourage sellers to offer discounts and/or incentives to attract buyers. And in Singapore, demand for private residential properties has a history of rebounding quickly after a crisis.

Why foreign property buyers invest in Southeast Asia

There are a number of compelling factors that point to the draw of buying property in Southeast Asia.

For starters, the low investment threshold in certain Southeast Asian markets represents a quick path to high rental yield. It’s reported that cities like Bangkok, Phnom Penh, and Manila can generate a 5% average return on investment (ROI) in the local real estate market.

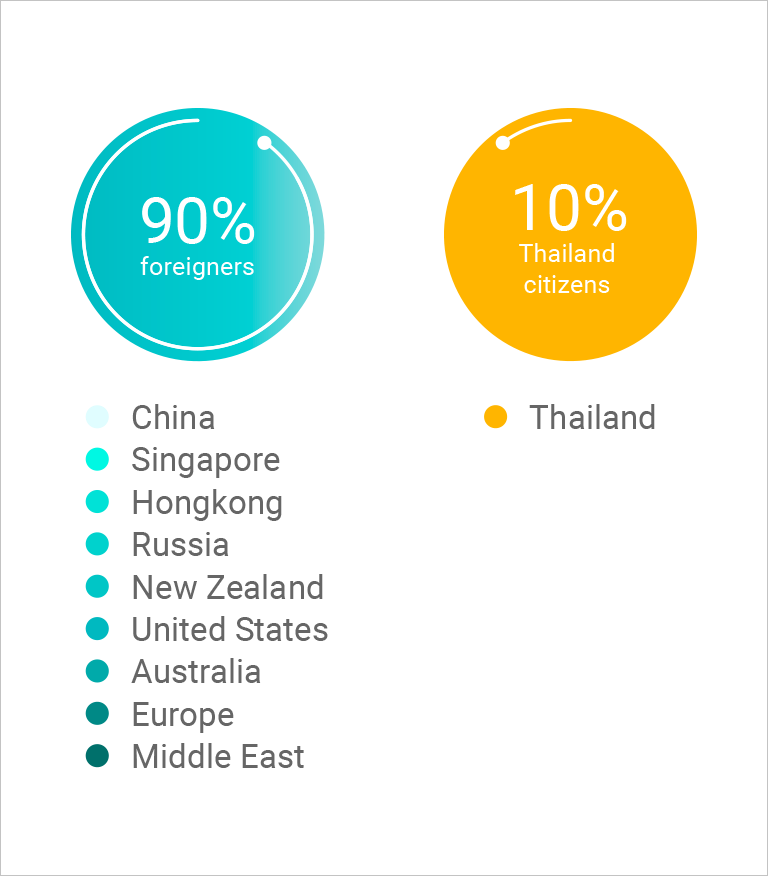

Demand for guaranteed returns is even higher in Phuket, where 90% of property buyers are reportedly foreigners from China, Singapore, and Hong Kong. In 2019, the city had 21 launches, 18 of which offered a guaranteed return to buyers.

Meanwhile, the launch of the Malaysia My Second Home (MM2H) programme helped to establish Malaysia as one of Southeast Asia’s top investor-friendly countries. Before the pandemic, Malaysia was predicted to see an increase in foreign property buyers after the government lowered the minimum price threshold for property sales down to 600,000 ringgit (US$145,000).

In Singapore, the city-state’s reputation of being one of the world’s most investor-friendly places has naturally made it a hub for foreign buyers looking for investment properties or second homes.

Despite the restrictions on visitors entering the country being initiated in February, international buyers still purchased 48 homes in Singapore’s Core Central Region in March 2020. Admittedly, this was a 32% decrease from March 2019 but is nevertheless remarkable considering the country was in the middle of a crisis.

Barriers to entry for foreign property investors

Despite the relative ease of buying property in Southeast Asia, there are still a number of challenges facing both property developers and foreigners looking to invest in real estate.

Varying property laws and regulations

For instance, there is the issue of Southeast Asia’s diversity.

The region comprises 11 countries, each one with its own language, culture, and legal rules and regulations, all of which can create potential trust issues for unsure buyers. While the majority of Southeast Asian countries allow freehold ownership of dwelling and/or land, there can be major differences in the specifics of these property laws between each country.

For example, Malaysia allows foreigners to buy certain types of land on a freehold basis. In contrast, in Thailand, foreigners are explicitly prohibited from owning land.

Inability to view Sales Galleries

There’s also the problem of foreign buyers not being able to see the actual Sales Gallery. Depending on the developer and real estate agent, this gap can be filled with technologies such as video conferencing, in combination with tools such as interactive displays, videos, and virtual tours of units. More recently, we’ve seen a rise in virtual showflats due to pandemic restrictions.

Gaps in communication

Finally, there’s the obstacle of bridging the communication gaps between local real estate agents and overseas property developers, both within Southeast Asia and outside of it.

For agents, the primary challenge is communicating with potential overseas property buyers and maintaining a sales pipeline that goes beyond borders and time zones. Because of the many nuances and legal restrictions for foreign buyers between each Southeast Asian country, agents play a key role in acting as intermediaries, helping developers provide a selection of properties that align with a foreign buyer’s needs.

For developers in Southeast Asia, the challenge is finding ways to access the sales networks of agents based in other Southeast Asian countries and outside the region.

Developers and agents need to work closely to ensure potential buyers get the necessary information they need to make a purchase decision, whether it’s images of the property, project charts, floor plans, or project type details.

Enter FastKey Projects Marketplace

Preview of FastKey Projects Marketplace Walkthrough

These challenges are at the heart of FastKey Projects Marketplace, a new feature of PropertyGuru’s FastKey property sales platform designed to help property developers access cross-border opportunities. FastKey Projects Marketplace lets you leverage an online network of more than 50,000 real estate agents across Southeast Asia, giving your properties extensive exposure beyond borders.

With the project information from property developers, each FastKey Project will be listed in the FastKey Projects Marketplace to be displayed exclusively to agents, which covers:

- Developer images and videos of the project, units, and amenities

- Diagrams and charts of the project

- Interactive Google Maps with points of interest near the project

- Floor plans of individual units

- Miscellaneous information about the project’s amenities and unit types

- Information about the developer’s commission scheme

As a developer, FastKey Projects Marketplace allows you to gain extensive exposure for your projects by tapping into a network of local agents based in four regions: Singapore, Malaysia, Thailand, and Indonesia. We’re also working on adding Vietnam to this list in the near future.

Developers looking to promote their listings can also sign up for FastKey Featured Projects to get preferred placement and position. Featured Projects appear with an Exclusive Highlights panel at the top of the FastKey Project tile, where agents can see your commission schemes, project images, logo, and contact information prominently.

PropertyGuru FastKey is designed to automate the full project sales cycle from launch to close of sale, helping developers leverage real-time data and unique insights to improve sales efficiency.

Contact us to know more about FastKey Projects Marketplace today and extend your project’s outreach across Southeast Asia!