SINGAPORE, 6 March 2023 – PropertyGuru, Singapore’s No.1 property marketplace with 81% market share[1], today revealed that 2 in 4 Singaporeans are likely to delay their plans to purchase a home due to inflation fears while 1 in 4 Singaporeans are considering dropping their plans altogether.

These findings are from the latest bi-annual H1 2023 PropertyGuru Consumer Sentiment Study (CSS), which measures the Singapore property market’s current consumer sentiments and expectations.

The study’s overall Sentiment Index – which measures current real estate satisfaction and overall climate, housing affordability, interest rates, perceived government efforts, and property prices – decreased to 43 points in H1 2023 report, down by 2 points from 45 in H2 2022 report.

The decline was driven by a dip in the affordability rating, despite an improvement in the overall satisfaction and current real estate climate score. The affordability rating decreased by 15 points, from 58 to 43.

More Singaporeans rate property prices at an expensive or too expensive level in H2 2022 – up 57% from 42% in H1 2022%) also feel that they are now somewhat unable or definitely unable to buy a property in H2 2022, compared to 25% in H1 2022.

Singaporeans re-evaluating their property plans until property prices stabilise and inflation drops

As inflation wears on, 55% of Singaporeans are considering delaying their property purchase until property prices stabilise. Meanwhile, a quarter (24%) voiced that they are likely to drop all plans to buy entirely.

Among those looking to buy a property, more (31%) are now considering an HDB BTO flat – an increase from 16% in H1 2022. 67% of Singaporeans who intend to purchase an HDB BTO flat are drawn to the affordability of these properties.

Despite growing affordability concerns, some Singaporeans are accepting of the hefty resale HDB flat price tags, with 3 in 10 (29%) finding it reasonable for these properties to be sold at $1 million or more. The sentiment is higher among those aged 30 to 39 years old and those in the high-income group.

Dr Tan Tee Khoon, Country Manager – Singapore, PropertyGuru, shares, “Given the increase in marginal Buyer’s Stamp Duty (BSD) announced in Budget 2023, we expect property seekers searching for private residential homes between the $1.5 million to $2 million price range to pause and recalibrate their purchase preferences. They may even further ‘right size’ their accommodation choices or consider HDB resale flats, especially if they are first-time applicants due to the enhanced Central Provident Fund (CPF) Housing Grants available. They would now have more financial muscle towards purchasing the larger flat types such as four- or five-room flats.”

HDB loans popular among HDB buyers and owners; those planning to refinance with bank loans looking to save more

Preference for housing loan types is more distinguished now, with more HDB buyers and owners (68%) opting to pick up an HDB loan during this climate – an 18% increase from 50% in H1 2022.

HDB loans continue to be popular among young adults aged 22 to 29 (77%) and low-income individuals (80%). 51% of HDB owners who had financed their home with an HDB loan also intend to stick with their existing housing loan type – a 17% increase from 31% in H1 2022.

Paul Wee, Vice President – PropertyGuru Finance, says, “HDB loans are priced at 0.1% above the CPF Ordinary Account (OA) rate, which makes it 2.6% – substantially below the effective rates of the loans from financial institutions. For those eligible to take on an HDB loan, it is natural for them to start their home financing journey with one. These borrowers can easily refinance later and move from an HDB loan to bank loan.”

However, property investors and landlords who own an HDB property still lean towards a bank loan – 64% and 59%, respectively. 61% of HDB owners planning to refinance with a bank loan state an opportunity to save more money – this is higher than 38% in H1 2022.

“As interest rates have risen over time, it makes sense for homeowners to regularly review their home loan for opportunities to save. They can also look at their loan tenure, assess the need for additional funds, or restructure their loan property ownership to optimise how they manage their loans,” advises Paul.

Singaporeans feel more can be done despite cooling measures impacting more homebuyers

Almost half of Singaporeans (48%) have indicated that they have felt the impact of the property cooling measures and are now looking for a less expensive property – a 9% increase from 39% in H1 2022. The impact of cooling measures is more strongly felt by property investors – 93% in H2 2022 from 57% in H1 2022. The higher interest rate floor was the top reason (55%) cited by homebuyers affected by the cooling measures.

On the other hand, a quarter of Singaporeans (25%) have shared that it has not influenced the price range of properties they are considering – especially among younger Singaporeans and those in the low-income group. 67% of Singaporeans expect more cooling measures to be introduced soon, with 20% expecting it to happen within H1 2023 and 47% within the year.

Just 1 in 3 Singaporeans (33%) agreed that the latest cooling measures have successfully promoted a stable and sustainable property market – more substantial among high-income individuals (38%). That sentiment is stronger among high-income individuals who are impacted by measures such as the increased Additional Buyer’s Stamp Duty (ABSD) rates and 15-month wait-out period for private property downgraders that are targeted toward the wealthier demographic. Most of those who agreed (56%) shared that the cooling measures have slowed the increase in property prices and value.

“The prices for private residential homes are expected to stabilise, as the acquisition costs for property seekers went up amid an uncertain economic environment. Nevertheless, the labour market remains tight and asking prices are unlikely to ease. Separately, the higher stamp duties and property taxes are targeted at the higher-end properties,” shares, Dr Lee Nai Jia, Head of Real Estate Intelligence, Data and Software Solutions, PropertyGuru Group.

“The new measures are unlikely to nudge the prices of high-end homes downwards because the demand for such homes tends to be price inelastic. Instead, the number of listings for high-end properties may drop as the sellers may prefer to wait out until the activity picks up again.”

About PropertyGuru’s Consumer Sentiment Study

Conducted half-yearly since 2009, PropertyGuru’s Consumer Sentiment Study measures property sentiments and expectations around the property market to help consumers, property agents, and developers gain a better perspective of the local property market. The H1 2023 Consumer Sentiment Study polled 1,000 Singaporeans via online questionnaires between 14 November to 28 November 2022.

About PropertyGuru Singapore

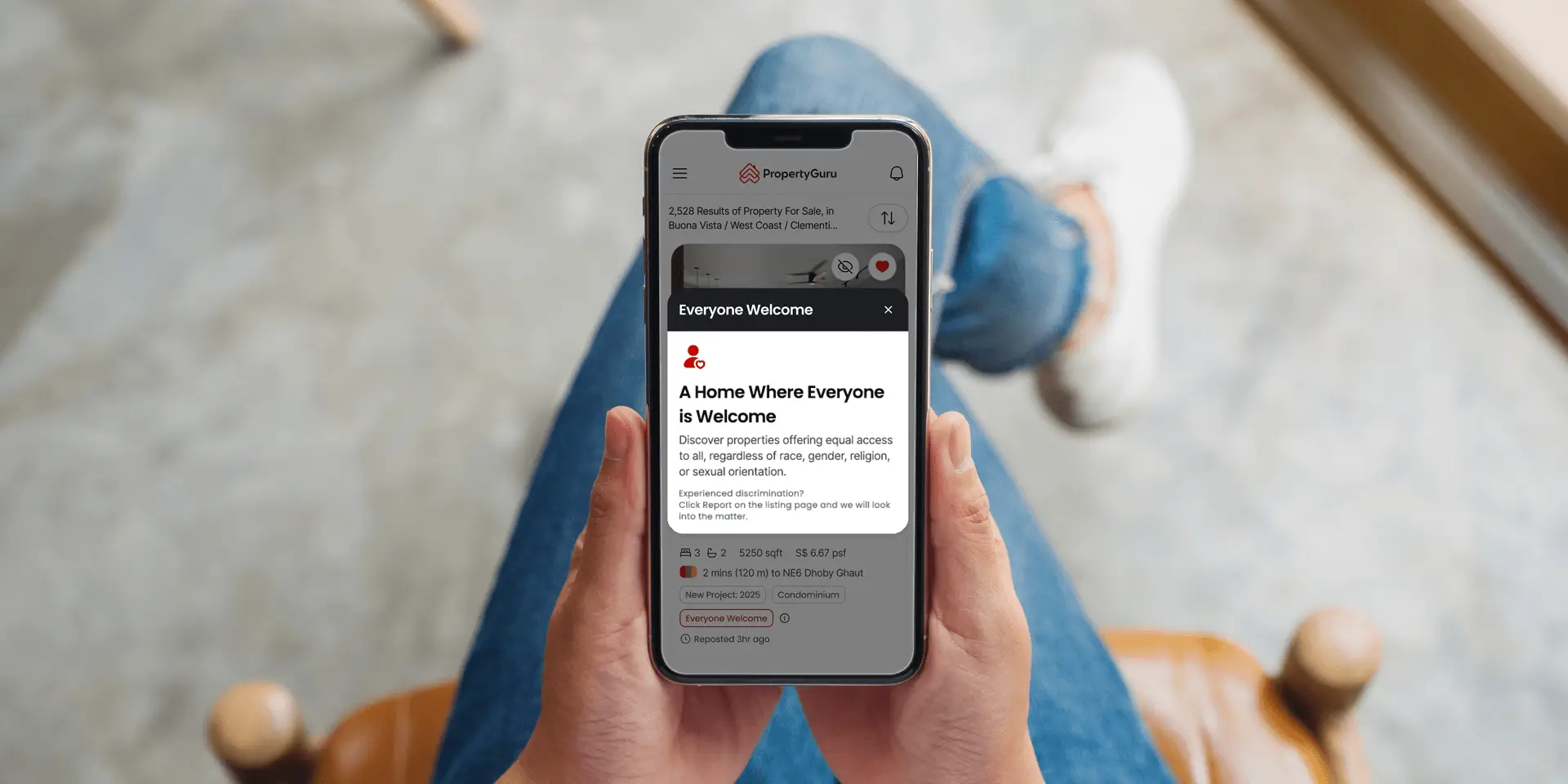

Launched in 2007, PropertyGuru.com.sg continues to be the No.1 property marketplace in Singapore. Currently with 81% market share[1], PropertyGuru is the preferred destination for property seekers to find, finance and own their dream home. PropertyGuru.com.sg transformed the way Singaporeans find homes by taking property online and has since been helping them make confident property decisions. In 2020, PropertyGuru launched mortgage marketplace PropertyGuru Finance offering the best loans and home advisory.

For more information about PropertyGuru, please visit PropertyGuru.com.sg and PropertyGuruGroup.com, or our social media pages on Facebook, Instagram, Twitter, YouTube, and LinkedIn.

|

For further queries or media interviews, please contact: |

|

|

Archetype Singapore Eugene Wee / Junyi Kuo +65 9631 8699 / +65 8660 4158 |

PropertyGuru Group Laveesh Hassija +65 8141 7801 |

[1] Source: SimilarWeb – Relative Engagement Market Share, average of Jul – Dec 2022